Electric car sales forecast to reach 580,000 in 2026, as electric van adoption surges

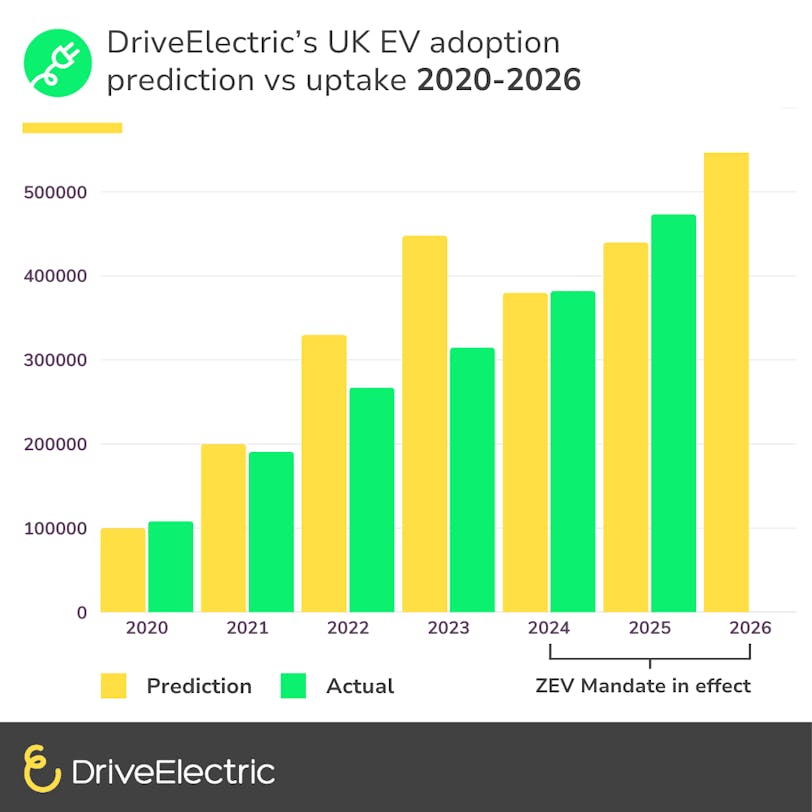

At DriveElectric, our latest market forecast shows that UK electric car sales are set to reach around 580,000 registrations in 2026, accounting for 29% of the expected two million new car registrations.

This forecast builds on our 2025 electric car sales forecast, published last year, which anticipated rising electric car sales despite wider market uncertainty. In 2025, electric cars accounted for 23.4% of new registrations (473,348 vehicles), and saw a particularly strong finish to the year, reaching 32.2% market share in December alone.

How close was our 2025 EV sales prediction?

Our forecasting approach is built on long-term insight into the UK EV market, and our 2025 prediction closely reflected actual sales.

While actual sales exceeded our forecast, the difference was driven largely by stronger-than-expected growth towards the end of the year. This reinforces the trend we highlighted in our earlier analysis: that EV adoption is accelerating, even as market conditions and regulations continue to evolve.

EV Sales: Forecast vs Actual (2025)

Metric |

Forecast |

Actual |

|---|---|---|

New electric car registrations |

440,000 |

573,348 |

Difference |

- |

+33,348 |

Variance |

- |

+7.5% |

How EV sales are tracking against the ZEV Mandate

Despite continued growth, electric car registrations alone remain below the UK’s Zero Emission Vehicle (ZEV) mandate headline targets.

In 2025, electric cars accounted for 23.4% of new car registrations, below the mandate target for that year. However, manufacturers were still able to comply thanks to built-in flexibilities, including credit banking and trading from previous years — an approach that is expected to remain important in 2026.

Looking ahead, our forecast suggests that electric cars will represent 29% of new registrations in 2026, compared with the ZEV mandate headline target of 33%.

Year |

EV Market Share |

ZEV Target |

|---|---|---|

2025 |

23.4% |

28% |

2026 (forecast) |

29% |

33% |

While this indicates that the car-only target may again be missed on paper, compliance is still expected to be achieved, particularly as electric van registrations count double under the ZEV mandate.

Electric van sales poised for major growth

One of the standout trends in our 2026 forecast is the rapid acceleration of electric van adoption. We expect electric light commercial vehicle (ELCV) registrations to increase by around 50%, reaching approximately 45,000 vehicles, up from 30,169 registrations in 2025.

This growth is being driven by significant improvements in electric van capability, with more models now offering real-world ranges of over 200 miles and payloads of one tonne or more, making them increasingly viable for business and fleet use. Importantly, ELCV registrations count double towards manufacturers’ ZEV mandate targets, further supporting market growth.

What’s driving EV adoption in 2026?

Our forecasts are informed by long-standing insight into the UK EV market and reflect several key developments shaping adoption:

- Greater affordability and choice, with more smaller and lower-cost electric cars entering the market

- Continued support from the UK Electric Car Grant, offering discounts of £1,500 or £3,750 based on manufacturing sustainability

- Manufacturer-led incentives for models not eligible for government grants

- Ongoing battery cost reductions and increased competition, including new entrants from China

- Improved range and faster charging, helping to address range anxiety and misinformation

The UK’s charging network is also continuing to expand. According to Zapmap, the number of rapid and ultra-rapid chargers grew by 23% in 2025, giving drivers greater confidence to make the switch.

Strong incentives for businesses and fleets

For businesses, financial incentives remain a key driver of electrification. Benefit-in-Kind (BiK) tax rates remain low at 3% until April 2026, rising gradually to 5% by April 2028. These incentives have fuelled the continued growth of EV Salary Sacrifice schemes, which can reduce the cost of driving an electric car by up to 40% for employees.

At the same time, many organisations are accelerating EV adoption to support carbon reporting and ESG objectives, helping them secure existing contracts and win new business.

Growing used EV market

With more than 1.8 million electric vehicles now registered in the UK, increasing numbers of EVs are entering the used market. This is expanding access to affordable used electric vehicles, available through Business Contract Hire, Personal Contract Hire and Salary Sacrifice, making electric cars and vans viable for an even broader audience.

Our view

Adam Kemp, Partnerships Director at DriveElectric, commented:

“There are a range of factors which will provide the opportunity for increasing numbers of motorists to make the switch to EVs in 2026, including the Electric Car Grant, continued incentives for fleet customers, interest rates reducing, and an extremely competitive EV market offering more affordable models with longer driving ranges..."

...but electric vans are set to be the most interesting story of 2026, with our forecasts showing a 50% increase in registrations, driven by longer ranges and more affordable new models.

Electric vehicles remain a vital part of the UK’s journey towards net zero, while also delivering lower running costs and a driving experience that many motorists now prefer over petrol and diesel alternatives.