The future of EV

Discover what the future of electric vehicles looks like

As electric cars continue to gain popularity, it is widely believed that EVs are the future of transportation. Not only will mainstream electric cars transform the automotive industry as a whole but most importantly, they will also help replace the use of fossil fuels in a bid to decarbonise the earth.

Electric vehicles will likely continue to become more prevalent in the coming years. It is projected that EVs could make up a total of 45% of global car sales by 2035. In contrast, sales of internal combustion engine (ICE) cars are expected to see a gradual decline as the market shifts towards EVs.

As the global EV market continues to grow, several automakers have announced their plans to increase the production of their electric car range. As a result, this provides additional opportunities to go electric, specifically speaking, electric car leasing and electric van leasing which is generally a more affordable alternative to buying a car due to its lower monthly costs.

To understand what the future of electric cars looks like, we’ve taken a deep dive into the most recent consumer trends. We’ve also made projections for the EV market based on the sales and production of electric vehicles, ICE cars and the used car market after 2030.

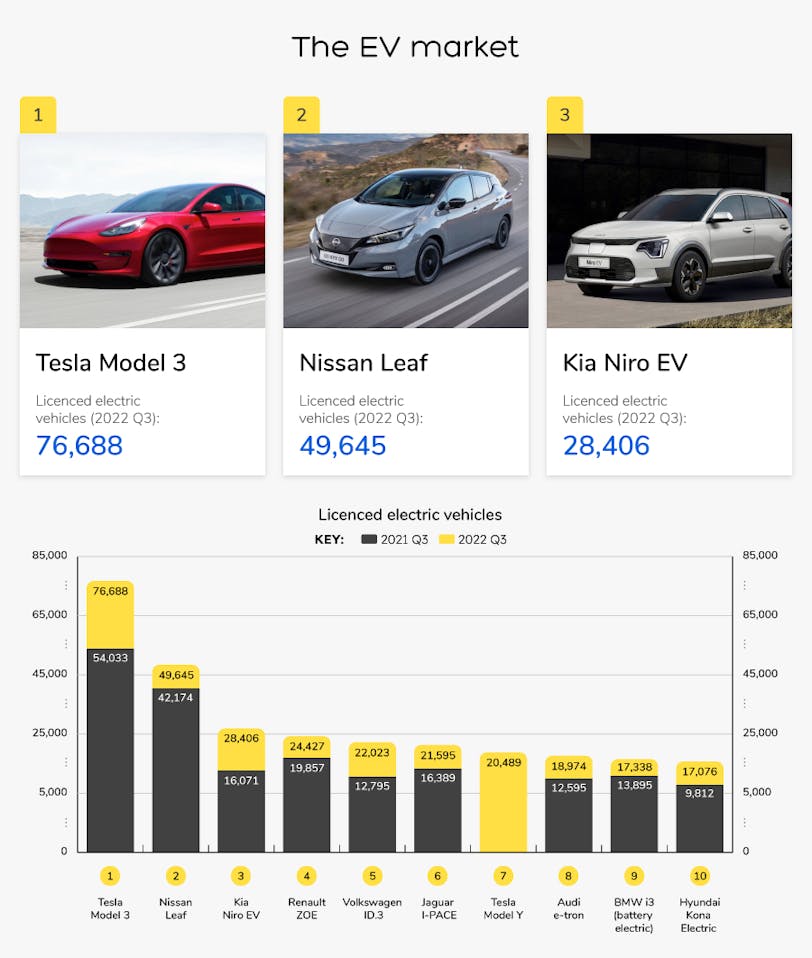

The EV market

There is no denying that in the last decade, the global EV market has grown exponentially, especially with sales growing by 43% from 2019. Research shows that the number of EVs sold in a week in 2021 was higher than the amount sold in the year 2012 as a whole.

Due to this level of immense growth, we decided to dig deeper and analyse the growth trends of EVs on a national scale. So we did some research to find out just how many electric cars were on the road in the UK by the third quarter of 2022.

1. Tesla Model 3

Number of Licenced EVs by 2021 Q3: 54,033

Number of Licenced EVs by 2022 Q3: 76,688

The Tesla Model 3 EV is currently one of the most-sold electric cars in the UK, with over 76,000 licenced EVs as of September 2022. Not only is this one of the best-selling automobiles in the country but it saw an increase of 42% in just one year. It also comes in at over 27,000 more licenced EVs compared to its runner-up, the Nissan Leaf.

As the Tesla Model 3 continues to grow in popularity it’s clear that after a surge in sales, this EV dominates on British roads.

2. Nissan Leaf

Number of Licenced EVs by 2021 Q3: 42,174

Number of Licenced EVs by 2022 Q3: 49,645

The Nissan Leaf follows behind with a total of 49,645 licenced cars by the third quarter of 2022 which is a decent increase from 42,174 compared to the year before. This electric family car is fully equipped with two battery capacity options and advanced tech which offers plenty of range, power and choice.

3. Kia Niro EV

Number of Licenced EVs by 2021 Q3: 16,071

Number of Licenced EVs by 2022 Q3: 28,406

The South Korean multinational automobile manufacturer, Kia, offers a pure electric family alternative. With a total of 28,406 electric cars licenced by the third quarter of 2022, the Kia Niro EV takes third spot.

This is very impressive as this more than doubled compared to the year before which was 16,071. This EV is efficient, and practical - boasting excellent onboard technology.

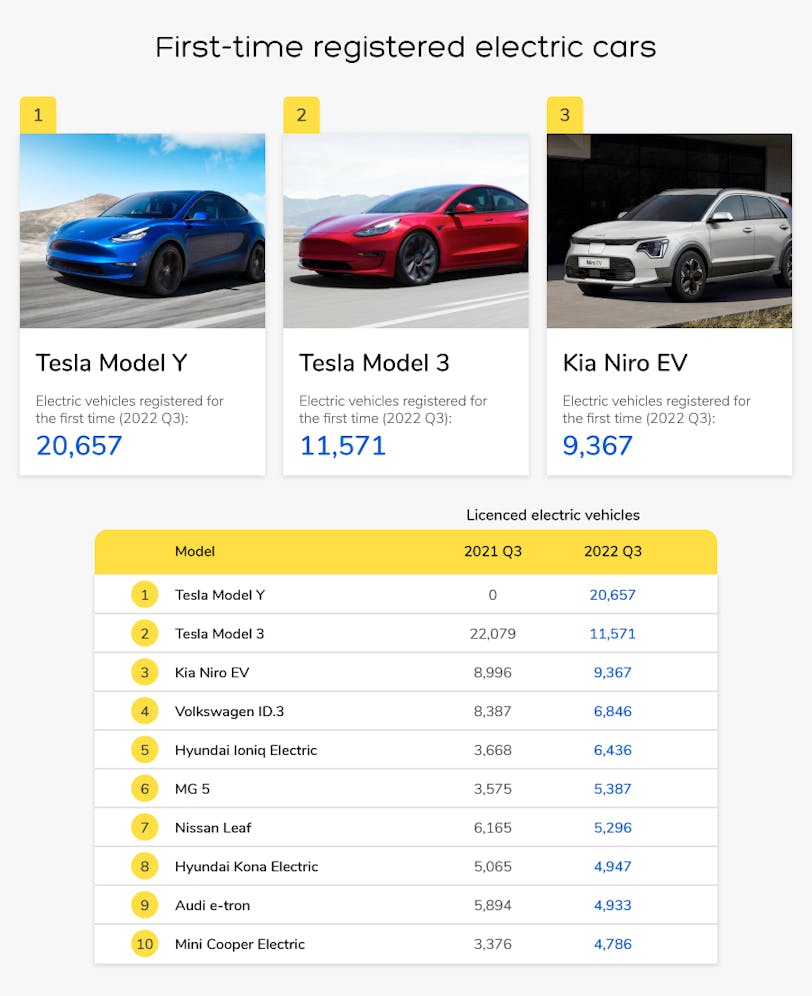

First-time registered electric cars

Research shows that 2022 saw a new level of growth when it came to EV sales. By December there had been a significant increase in new EV registrations resulting in a massive market share of 32.9% in the UK. Needless to say, the EV market is growing – and it’s growing fast.

To better understand just how rapidly the EV market is growing, we did some in-depth research on the number of first-time registered electric cars in the UK.

1. Tesla Model Y

Electric vehicles registered for the first time (2022 Q3): 20,657

When it comes to the number of first-time registered electric cars, the Tesla Model Y tops the list with a total of 20,657 in the third quarter of 2022. This comes as no surprise as this electric SUV is more than capable of withstanding various weather conditions and is a cutting-edge alternative to many other electric vehicles.

2. Tesla Model 3

Electric vehicles registered for the first time (2022 Q3): 11,571

Tesla strikes again - this time with the Tesla Model 3. Despite showcasing a difference of a staggering 9,086 in first-time registrations when compared to the Tesla Model Y - this airy, modern and compact executive saloon comes in second place.

In the third quarter of 2022, the Tesla Model 3 had a total of 11,571 first-time registered electric cars which is a significant decline from the year before which had 22,079 EVs first-time registers by its third quarter.

3. Kia Niro EV

Electric vehicles registered for the first time (2022 Q3): 9,367

Ranking in third place is the Kia Niro, with a total number of 9,367 first-time registered electric cars. This is 4% higher than just the year before. Comprised of refined styling, next-generation technology and smart features, this all-electric vehicle offers great value for money, starting from a retail price of just £36,795.

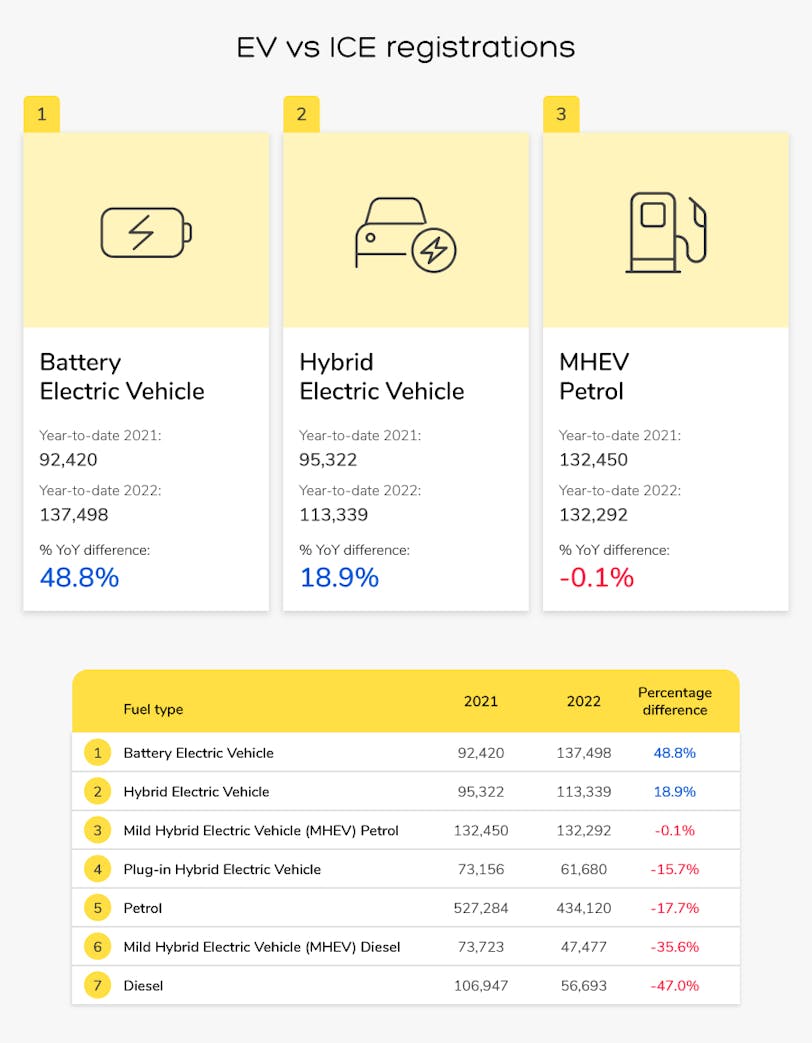

EV vs ICE Registrations

According to research, the growth of EVs will only continue to rise with 42,284 registrations of battery-electric cars in December 2022 alone. This has resulted in a market share of 32.9% when it comes to all new car registrations - but as EVs continue to gain more popularity, what does this mean for internal combustion engine vehicles (ICEs)?

Well, studies have shown that there has been a drastic decline in the registration of various ICEs. Diesel in particular saw a massive -47.0% decrease in 2021-2022 registrations, whilst petrol registration decreased by 17.7%.

Taking a closer look at the UK’s registration data we ranked the number of EV and ICE registrations in order of their percentage difference. This data is primarily based on the year-to-date from 2021 to 2022.

1. Battery Electric Vehicle

Year-to-date 2021: 92,420

Year-to-date 2022: 137,498

% YoY difference: 48.8%

Coming in first place by a landslide are battery electric vehicles which have grown by a whopping 48.8% from 2021. In 2022, EVs there were approximately 137,498 registrations, this has risen from 92,420 when compared to the year before.

2. Hybrid Electric Vehicle

Year-to-date 2021: 95,322

Year-to-date 2022: 113,339

% YoY difference: 18.9%

Hybrid electric vehicles come in second place, going from 95,322 in 2021 to 113,339 a year later, highlighting a growth rate of 18.9% in just one year.

3. MHEV Petrol

Year-to-date 2021: 132,450

Year-to-date 2022: 132,292

% YoY difference: -0.1%

Ranking in third place are mild hybrid EVs, new registrations for these vehicles experienced a difference of -0.1%. This comes as a result of experiencing a slight decrease, going from 132,450 in 2021 to 132,292 in 2022.

Projections for the EV market

Research indicates that Tesla is the most sought-after EV brand. Not only is the brand one of the largest electric car producers in the world but its models, the Tesla Model Y and the Tesla Model 3 have both set records in the UK despite being relatively new to the EV market,

By the third quarter of the year, the Tesla Model 3 had 76,688 licenced (all vehicles that can legally use the road) electric cars while Tesla Model Y received the most number of first-time registrations (also known as new registrations) in the same quarter with a total of 20,657.

Based on the 2021 census, over half of the younger drivers in the UK will most likely switch to electric cars in the next decade. Conducted between September and October 2021, the survey highlighted that 44% of all petrol, diesel and hybrid drivers were interested in switching to an all-electric vehicle during the next decade.

The majority of consumer perceptions changing towards EVs majorly stem from environmental concerns. Preference for electric vehicles continues to grow as more than 50% of people planning to buy a car will choose either fully electric, plug-in hybrid, or hybrid vehicles.

Electric car chargers in the UK

As electric car sales continue to rise so does the demand for electric charging in the UK. Most early adopters primarily relied on home charging (some people still do), but with more people making the switch to EVs, there is a real need for more accessible public charging points.

As a result, in recent years we have seen an increase in the number of public EV charging points. According to research, the charge point network grew four-fold between the end of 2016 and 2021, going from 6,500 to over 28,000 devices.

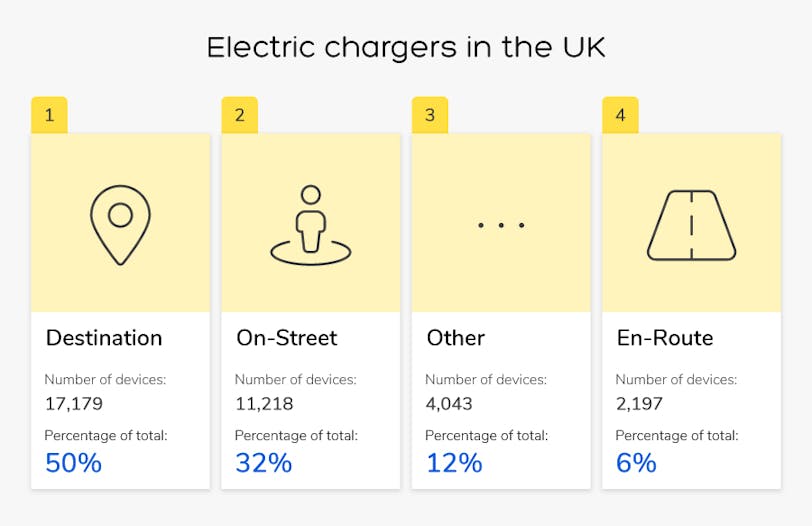

Focusing on the growth of electric car chargers in the UK, we took a closer look at the location of the various charging devices. We also looked at the number of devices currently in the UK as well as the total percentage for each device.

1. Destination

Number of Devices: 17,179 | Percentage of Total: 50%

Destination electric charging stations are the most prominent in the UK. This is no surprise as they provide useful charging points for EV drivers, from shopping centres to public car parks. As of October 2022, there were 17,179 destination-based public charging devices, accounting for a whopping 50% overall.

2. On-Street

Number of Devices: 11,218 | Percentage of Total: 32%

On-street charging devices were the second most predominant public charging devices. As the increasing demand for on-street charging infrastructure grows, local authorities in the UK have been proactively delivering the rollout of electric vehicle charge points.

As a result, it was reported that there were 11,218 on-street charging devices by October 2022 which is 32% of the total number of public charging devices in the UK.

3. Other

Number of Devices: 4,043 | Percentage of Total: 12%

The ‘other’ category comes in third place with a total of 4,043 charging devices. This includes other electric car plug types, such as CHAdeMO and Type 1 EV connectors. As of October 2022, this accounted for 12% of the number of public charging devices in the UK.

4. En-Route

Number of Devices: 2,197 | Percentage of Total: 6%

En-route charging points come in fourth place with a total of 2,197 as of October 2022. Specifically for long journeys, these charging points currently account for around 6% of the public charging devices in the UK.

Projected number of electric chargers in the UK by 2030

In 2021, the UK government officially confirmed the pledge for zero-emission vehicles (ZEVs) within the next two decades. On a global scale, ZEVs grew drastically from 2.1 million in 2019 to 5.3 million in 2021.

It is also forecasted that ZEVs will be a whopping 70% of all new car sales in 2040, this projection doubled in the last five years.

As a result of this level of projected growth, research shows that a target of 300,000 electric vehicle chargers will be made publicly available in the UK by 2030.

This announcement comes just after a record-breaking year for the number of public electric car chargers in 2022. In a race to dominate a fast-growing EV market, more than 8,700 chargers were installed by December 2022, bringing the total to 37,000. This showcases an impressive 30% increase in just one year.

With this level of growth sustained, the year-on-year increase of 30% would be enough to hit the target number of electric chargers. This would also mean that annual installations will more than double to 19,000 by 2025 and accelerate from there.

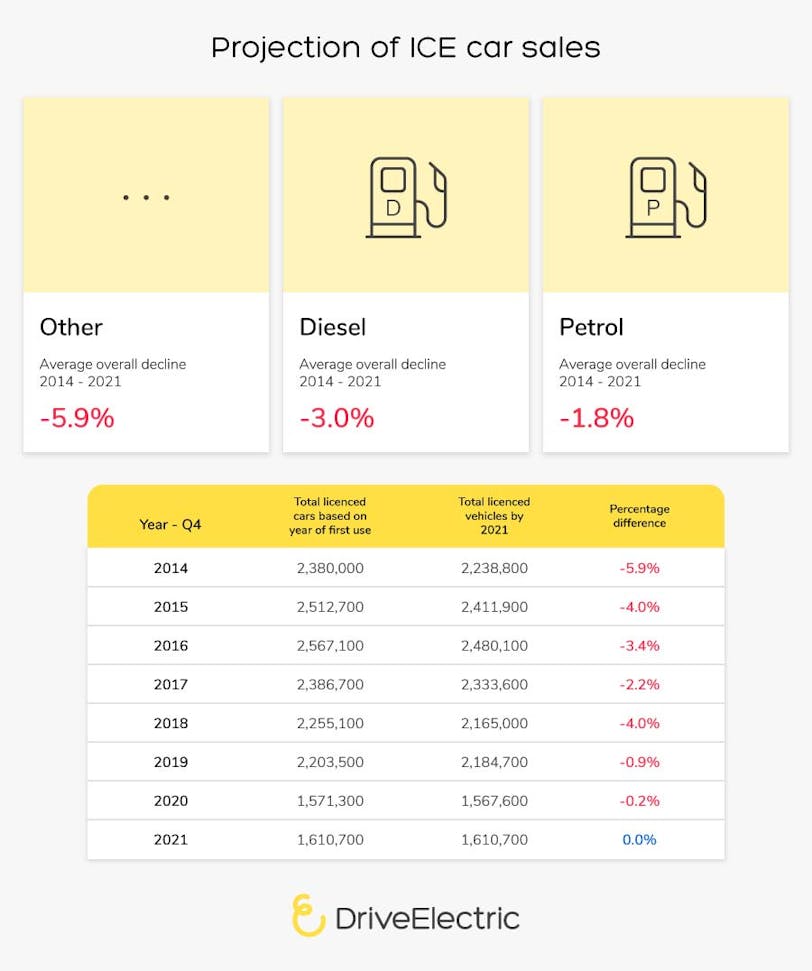

Projection of ICE car sales

According to recent figures, battery electric vehicles are set to overtake ICEs in the UK car market by 2025. One-third of used car sales will be EVs by 2030 and are projected to account for approximately 10% of the British car market.

In 2021, EVs made up just 3.1% of the total number of cars on the road. This equates to just under 400,000 cars. By 2025, this figure is expected to double to an estimated 6% and an even higher figure of 19% by 2030 with 6.4 million cars forecasted on the road.

What will the used car market look like after 2030?

After the government's announcement of the ban on new petrol and diesel cars, there has been a lot of speculation as to what the used car market will look like after 2030. From 2030 onward, those buying new cars will primarily only have a choice of battery-electric vehicles or cars fuelled with hydrogen.

The main reason for this shift in trends is the idea that banning the purchase and production of new petrol and diesel cars is expected to reduce greenhouse gas emissions and eventually reach Britain’s goal to be net zero by 2050.

Although buying and selling used ICE cars will still be allowed, it is expected that the resale values of traditional ICEs will most likely take a huge hit due to a fall in demand.

Methodology

Looking at the vehicle licencing statistics data sets on GOV.UK, this research specifically takes licenced plug-in vehicles (PIVs) and is filtered by the relevance of battery electric and range-extended electric cars in the UK.

The projections of the EV market breakdown licenced electric cars by body type, and model as well as highlight the difference in quarterly figures. Other sources used also include the Office for National Statistics and EY.

Projections on ICE cars were based on the comparison of Licenced vehicles at the end of the year with the first year of use. To help add more context, additional sources such as JustAuto were also used.

Information on what the used car market will look like after 2030 can be found in The Sunday Times, Express and Yahoo Finance.

Data for the number of electric chargers in the UK was taken from EV charging device statistics. This table specifically looks at the location of public charging devices as of 1 October 2022 as well as the percentage and number of devices. Further supporting sources were used such as Zap Map and The Guardian.